One of the largest conventional mortgage originators in the United States had a battle-tested underwriting model that was showing signs of age. Many users had modified it over the years and the company’s focus had evolved. Even worse, there was a complete lack of documentation about who changed what and when.

They needed to keep what worked but also wanted updated formulas and functions so the model would run properly in modern Excel. They also wanted to freshen the design and add many complex and large additional features for the new lending products that were a growing part of their business.

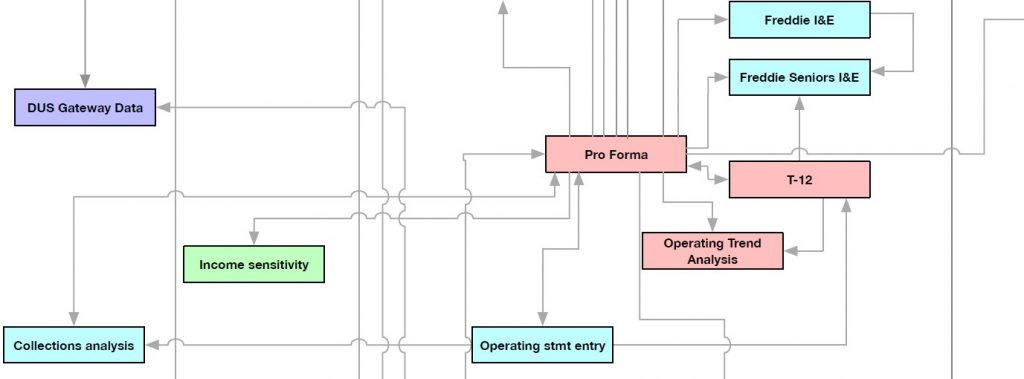

Our team worked with their internal constituents across multiple offices to design an updated underwriting model that covered both the affordable and conventional space. We then used an iterative approach that began with diagramming the proposed model’s core features and documenting what links would be built across tabs. Our design was informed by the requirements of the different deal teams.

The architectural diagrams progressed to rough skeletons that allowed the Kahr team to focus its discussions with the client team on each tab’s content and layout prior to working through the formulas. Following the skeleton creation process, we created a working unlevered cash flow model and then a levered cashflow version of the model. Our approach included multiple testing phases as well to debug and verify requirements along the way.

Best of all, when it was all done, it was fast. It’s one thing to build a complex financial model; it’s a whole other thing to create one and make it efficient.